Unlike one-time payments, a user can cancel an order through PayPal to prevent further charges. Nowadays, premium channels are numerous and they entice users to their platform by gating their premium content. To access such platforms, we often sign up to become a member of such websites.

But most times, the experience isn’t always pleasant and the user ends up not getting value for money paid.

In instances such as this, a user can decide to cancel an order through their PayPal account and end their subscription to the website. By canceling a subscription order, the user must be prepared to lose access to perks that come with such a subscription. This is because many websites will terminate your access once a PayPal subscription is canceled.

To cancel a PayPal subscription order, a user must be sure and ready to end their access to the premium content they have subscribed to. One factor to keep in mind is that it is best to discuss available options with the platform before cancellation. This gives the user an insight into the likely outcomes of their decision as well as any available alternative means.

Subscription platforms can protect themselves from been ripped off once they are aware of the cancellation. They can effectively stop the distribution of gated content to a user who has canceled their order.

In this article, We at Daniel’s Hustle will examine how a subscription order can be canceled through PayPal.

Why use PayPal?

PayPal is a handy tool for sending and receiving payments online from both domestic and international sources. Your friends, family, clients, and customers can easily leverage the platform to get funds across to you with ease. The platform has many benefits it offers its users and we will consider a few of those benefits.

Easy to use

One factor that endears PayPal to a lot of its teeming users is the fact that the platform is easy to use regardless of tech skills. The platform has an easy-to-use yet simple outlook. Its organized interface ensures that it’s simple to navigate through.

For further simplicity, the platform has a mobile app that is compatible with iOS and Android mobile devices as well as tablets. The platform also has a bill-splitting feature called Money Pool. This allows users to accept funds from multiple friends to offset shared expenses or donate to a cause.

Popular payment platform

PayPal is a popular, widely-used, and accepted personal and finance app. Its share popularity means it’s easy to transact business as chances are that the receiver has a PayPal account. Also, the platform supports both domestic and international payments.

Popular stores such as eBay, Apple, Amazon, Target, Overstock, and The Home Depot all accept payment via PayPal. Another plus side of using PayPal is that users also get to store their store loyalty cards within the app. This means they can get rewarded for shopping on their favorite platforms.

If you are thinking of holding a fundraiser, think of PayPal. The platform makes it easy to organize and receive donations for whatever legal purpose. It doesn’t charge any fee for using the ‘Giving Fund’ page feature to raise money.

Supports International Money Transfers

PayPal is available in over 200 countries all over the world making the need to send money abroad easy. Just ensure you make adequate provisions for the charges attached to such transactions.

Users can also hold multiple currencies in a single PayPal account, send and receive payments in other currencies as well as convert their PayPal balance to another currency. This flexibility allows for seamless international transactions with been able to leverage the best deals available. Irrespective of your current location and currency!

Safe to use

PayPal is known for the safety and security of transactions made on its platform either the web or the app. The platform doesn’t share its user’s financial data when they make purchases or transfer funds to friends and families.

Additionally, its protection policies expressly cover its users when they are buying or selling products online. Should a buyer not receive a product or service purchased via PayPal, the platform gets you your money back.

Multiple payment methods

When we said the platform was easy to use, we didn’t mention the funding payment method. The PayPal platform allows users to fund their transactions online through various means.

So a user can decide to use any of the following such as bank account, debit card, credit card, or PayPal balance. Whichever method is convenient for the user is available and they are not restricted to one way. The only catch here is that some methods such as credit cards have charge fees associated with them.

Why cancel an order through PayPal?

An individual can choose to cancel an order through PayPal for many reasons. And since most order made via PayPal are repeated transactions, it becomes easy to just put a stop to it all:

- The content provided by such a subscription order is not what they were expecting. It is easy for users to get lost in the myriad of information world that we live in today. So while a user might actually at the point of subscription be getting the needed information, it’s easy to lose them along the line. When this happens, a user feels the need to cancel the order.

- A user can cancel an order through PayPal if they are not seeing value for the money paid. If the services or product paid for is subpar, they can choose to cancel.

- Ultimately users cancel an order through PayPal if and when they find themselves in a declining financial situation. This effectively makes it difficult to keep up with the payment obligations and as such, they decide to cancel.

- If a user is changing his or her location, chances are they will cancel an order. This becomes necessary if the service is not present in the location they are heading to.

- This is another major reason users cancel orders. A user might have over time lost interest in the activity that a subscription order offers and as such sees no reason to keep paying for it.

- No doubt, the level of competition is increasing daily. Newer platforms are looking for customers and are always eager to churn out impressive deals. Most times, they refer to lowering the price tag to attract customers. A user can decide to end their subscription order and move to the more favorable one.

Impact on Business

This knowledge is also useful for businesses that offer subscription orders on their platform with a PayPal payment integration. While orders are on an opt-in basis, this also allows for customers to be able to cancel an order at any time without prior notice. For businesses with subscription plans, access will stop upon attaining the period underpayment from a customer.

Businesses can use this knowledge to figure out why customers are leaving their business. To achieve this, simply send them a polite email asking them the reason for canceling. This is a potential starting point for a solution to prevent further cancellation from subscribers. One simple trick to reduce cancelation is for businesses to ensure they are rendering value for money.

How to Cancel an Order through PayPal?

To cancel an order through PayPal is quite simple, easy, and straightforward. Simply follow the steps below to achieve this:

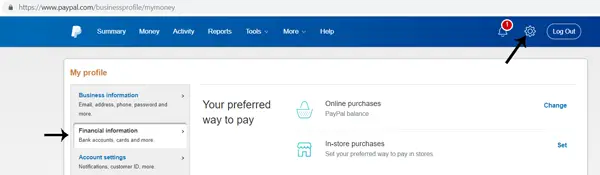

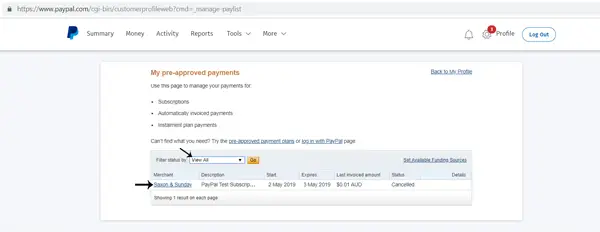

- Log into your PayPal account where the order was made from.

Click on the ‘cog’ icon. Then proceed to select the ‘Financial Information’ menu. - Scroll to and click on the ‘Manage Automatic Payments’ button. This is just below the ‘Automatic Payments’ section.

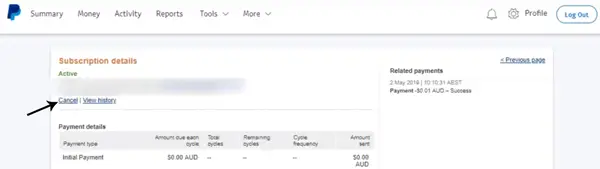

- This displays all your recurring payments. Select the ‘Merchant’ name for the payments you wish to cancel.

- A ‘Cancel’ button is right above the transaction details. Click this button.

- A cancellation confirmation prompt pops up and you have to confirm your cancelation action.

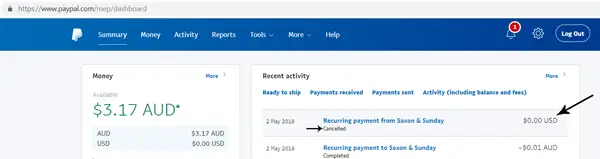

- Upon successful cancellation of the order, a record of the cancellation is made under your ‘Recent Activity’.

If you follow the above steps accordingly, you will have successfully canceled such order payments through your PayPal account.

Getting More from PayPal: Individuals and Businesses

Besides making and receiving online payments, PayPal can also help with other transactional experiences for businesses and individuals. A user can access a personalized PayPal card reader or simply use PayPal for currency conversion. Below are a few of the extra features and services users can leverage to maximize their experience on the platform:

PayPal Here

The PayPal Here app is available for mobile transaction processing. The design of the platform is to help beginners carry out transactions and doesn’t require technical skills. Received funds appear almost immediately in your PayPal account. It also doesn’t charge any subscription or software fees, so users don’t need to worry about cuts in their funds.

Online invoicing

Businesses can rely on the online invoicing feature of PayPal to ensure that they get the right amount for their products and services. Online invoicing from PayPal provides businesses with numerous templates and themes to grow. The feature allows for a setup for installment payments instead of an outright transfer. Businesses can go a step further by adding a tipping option to their PayPal invoices.

POS systems

Not many are aware that PayPal also offers an advanced cash card reader or POS system. Businesses can simply integrate PayPal into many partner solutions to enjoy this service. Certainly, this isn’t free as one needs to consider the extra cost of the software subscription. Ultimately, there is no expensive cost when including new technology into a business for improvement.

PayPal.Me

This is an ideal option for businesses that are just transitioning to selling some of their products and services online. This feature can allow buyers without a PayPal account to make purchases and the seller still receives payment effortlessly. However, users still have to be honest about their disclosure of which payments are personal or commercial.

Marketing solutions

There are certainly better marketing solutions available for customer conversion online from that of PayPal. Nevertheless, it is still available on the platform. Businesses can leverage essential conversion information and analytics details to help improve. As a plus, the Marketing Solutions are available in combination with all of the online processing options from PayPal. Also, users outside of the United States of America can also employ it.

Payment Gateway

PayPal’s payment gateway for online payments comes as part of its online processing tool collection. Also, businesses that don’t have any gateway software but utilize credit card processors can rely on a standalone version of PayPal’s gateway.

Mass pay-out

The way we perform business tasks is different from before. And businesses are always looking for ways to become more efficient and reliable in the discharge of their functions. With that in mind, many businesses hire freelancers or contract staff. The beauty now is that you can pay them all via PayPal.

By employing the platform’s Mass Pay-out feature, businesses can ensure that they can send multiple payments at once. Eliminating the stress associated with making one payment at a time. An ancillary benefit of the mass pay-out feature is that the business gets to save money from standard rates charges.

Conclusion

In this article, we’ve shared with you how you can cancel an order through PayPal quickly without stress. This piece also provides valuable insights on the other aspects of PayPal that users might not be aware of. These aspects can help your business improve on its day-to-day operations which in turn drives revenue for you.